Weekly Market Insights | July 29th, 2024

Down Corporate Reports Shake Investors

Stocks had a mixed, see-saw week as disappointing corporate reports unsettled investors who appeared to rotate away from some leading groups in favor of other names.

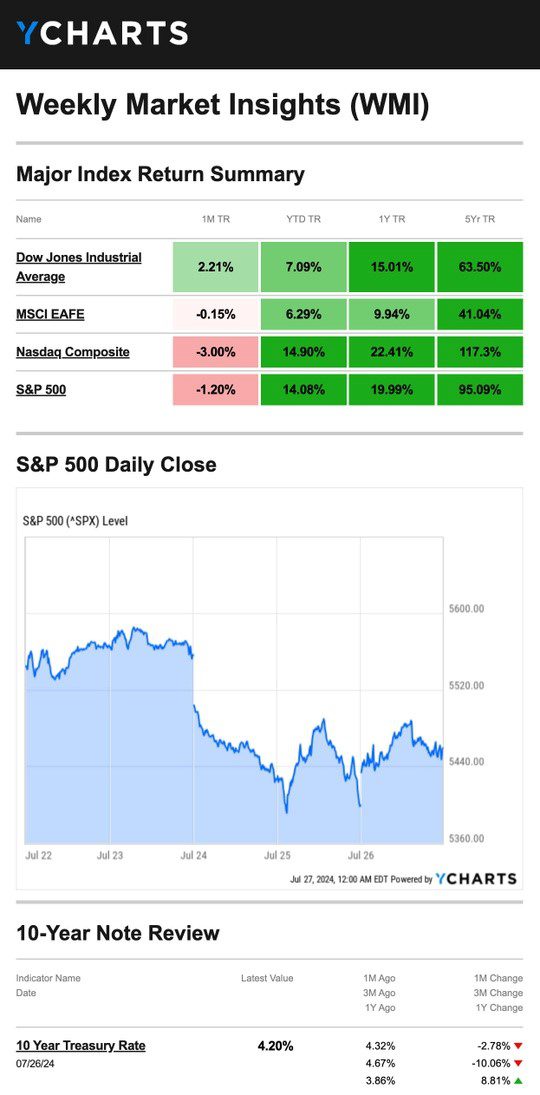

The Dow Jones Industrial Average picked up 0.75 percent. Meanwhile, the Standard & Poor’s 500 Index declined 0.83 percent, and the Nasdaq Composite Index dropped 2.08 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, fell 1.49 percent for the week through Thursday’s close.1

Q2 Corporate Reports Start

Last week began with some positive momentum, but after Tuesday’s close, two influential tech companies reported disappointing Q2 numbers, which soured sentiment. On Wednesday, the S&P dropped 2 percent, and the Nasdaq fell more than 3 percent.

Stocks attempted to rebound on Thursday on news that gross domestic product grew much faster than expected in Q2, but sellers swooped in near the close.3

Stocks rallied broadly on Friday after a positive inflation report. The personal consumption expenditures index, widely considered the Fed’s preferred inflation measure, showed only a slight uptick in June—in line with expectations.4

Source: YCharts.com, July 27, 2024. Weekly performance is measured from Monday, July 22, to Friday, July 26.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Watch the Rotation

July 26 saw the end of the third consecutive week in which the Dow led the other two averages and its fourth straight week of gains.

At the same time, the S&P and Nasdaq have been under pressure, with both posting losses for the second consecutive week.

So far in July, the Dow is up nearly 4 percent, the S&P is down slightly, and the Nasdaq is off by over 2 percent. That’s a marked change from earlier in the year when the Nasdaq led.5

This Week: Key Economic Data

Tuesday: FOMC Meeting Begins. Consumer Confidence. Case-Shiller Home Price Index.

Wednesday: Treasury Refunding Announcement. ADP Employment Report. Pending Home Sales. FOMC Announcement. Fed Chair Press Conference.

Thursday: ISM Manufacturing Index. Jobless Claims. Productivity and Costs. Construction Spending.

Friday: Employment Situation. Motor Vehicle Sales. Factory Orders.

Source: Investors Business Daily – Econoday economic calendar; July 26, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: McDonald’s Corporation (MCD)

Tuesday: Microsoft Corporation (MSFT), The Proctor & Gamble Company (PG), Merck & Co., Inc. (MRK), Advanced Micro Devices, Inc. (AMD), Pfizer Inc. (PFE), S&P Global Inc. (SPGI), Starbucks Corporation (SBUX)

Wednesday: Meta Platforms, Inc. (META), Mastercard Incorporation (MA), T-Mobile US, Inc. (TMUS), QUALCOMM Incorporated (QCOM), The Boeing Company (BA), Automatic Data Processing, Inc. (ADP)

Thursday: Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), Intel Corporation (INTC), ConocoPhillips (COP), Booking Holdings Inc. (BKNG), Vertex Pharmaceuticals Incorporated (VRTX), Regeneron Pharmaceuticals, Inc. (REGN)

Friday: Berkshire Hathaway Inc. (BRK.A, BRK.B), Exxon Mobil Corporation (XOM), Chevron Corporation (CVX)

Source: Zacks, July 26, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“Every man is working out his destiny in his own way and nobody can be of any help except by being kind, generous, and patient.”

– Henry Miller

Tax Tip…

Start a New Business Off on the Right Foot

Starting a new business? There are some tax tips to know to get yourself moving in a positive direction something like that the Internal Revenue Service (IRS) shares for new business owners:

Choose the proper business structure: The form of business determines which income tax return a business taxpayer needs to file. The most common business structures are a sole proprietorship, a partnership, a corporation, an S corporation, and an LLC.

Apply for an Employer Identification Number (EIN): An EIN is used to identify a business.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Healthy Living Tip…

Summer Skincare Tips

The first and most important tip is always to wear sunscreen, even if you spend little time in the sun. Some skincare products, including makeup, have sunscreen built-in, but you should consider using a moisturizer with at least SPF 30 for extra protection.

Another good summer tip is to lighten up your skincare routine. In the summer, you’re likely sweating, swimming, and spending time outside so you might not need as much makeup or products as you do in the winter.

Tip adapted from Allure7

Weekly Riddle…

I am usually only as wide as a thumb and typically travel across the nation for less than a dollar, all while lying flat. What am I?

Last week’s riddle: What has two hands but will never clap? Answer: A clock.

Photo of The Week…

Flamingos in Flight

San Pablo, Potosí, Bolivia

Footnotes And Sources

1. The Wall Street Journal, July 26, 2024

2. The Wall Street Journal, July 26, 2024

3. The Wall Street Journal, July 25, 2024

4. CNBC.com, July 26, 2024

5. The Wall Street Journal, July 26, 2024

6. IRS.gov, May 8, 2024

7. Allure, May 8, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.