Weekly Market Insights | July 22nd, 2024

Investors Shift, Anticipating Lower Interest Rates

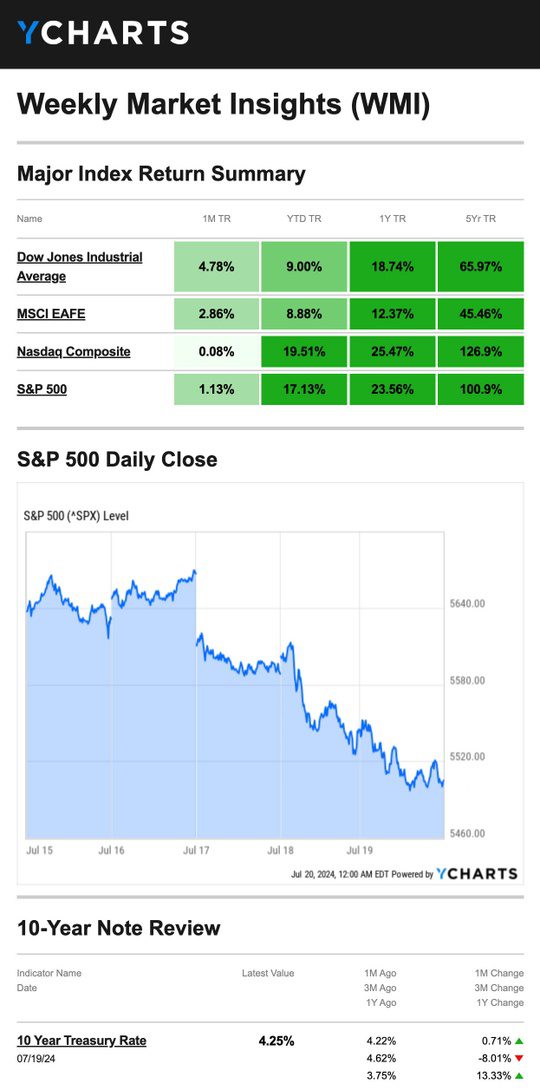

Stocks were under pressure last week as investors appeared to rotate out of mega-cap tech stocks and into areas that may benefit from lower interest rates.

The Standard & Poor’s 500 Index fell 1.97 percent, while Nasdaq Composite Index declined 3.65 percent. The Dow Jones Industrial Average bucked the downward trend, up 0.72 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slid 1.48 percent for the week through Thursday’s close.1

Dow Leads Again

The week began very differently than it ended.

All three averages rallied over the first couple of days this week, with the Dow leading on both days. Fed Chair Powell indicated the Fed may not wait for inflation to reach its 2 percent target before considering a rate move, buoying the markets.2,3

Then, markets hit a speed bump as investors appeared to take profits and rotated away from mega-cap tech names. The selling broadened beyond tech-related names on Thursday as all but one of the S&P 500’s 11 sectors fell.

Early Friday morning, a global tech outage caused disruptions for businesses, governments, and financial institutions, contributing to the weekly decline. Despite its losses in the second part of the week, the Dow finished in the green.4,5,6

Source: YCharts.com, July 20, 2024. Weekly performance is measured from Monday, July 15, to Friday, July 19.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period.

Treasury note yield is expressed in basis points.

Upbeat Economic Data

Although stocks were under pressure, some investors saw “green shoots” in a few economic reports. Housing starts rose 3 percent in June. Building permits also ticked higher during the month. Retail sales were unchanged in June, which was better than expected. Investors were encouraged that consumers were still spending despite ongoing inflation.7,8

This Week: Key Economic Data

Tuesday: Existing Home Sales.

Wednesday: New Home Sales. Survey of Business Uncertainty.

Thursday: Gross Domestic Product (GDP). Durable Goods. International Trade in Goods. Jobless Claims.

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; July 19, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Verizon Communications Inc. (VZ)

Tuesday: Alphabet Inc. (GOOG, GOOGL), Tesla, Inc. (TSLA), Visa Inc. (V), The Coca-Cola Company (KO), Texas Instruments Incorporated (TXN), GE Aerospace (GE), Philip Morris International Inc. (PM), United Parcel Service, Inc. (UPS)

Wednesday: International Business Machines Corporation (IBM), AT&T Inc. (T)

Thursday: AbbVie Inc. (ABBV), Union Pacific Corporation (UNP), Honeywell International Inc. (HON)

Source: Zacks, July 19, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.”

– Aristotle

Tax Tip…

Protect Your Tax Data

The Internal Revenue Service (IRS) shared guidelines that tax pros should follow to protect taxpayer data, but these principles are sound for everyone to practice.

-

Anti-virus software: This software scans computer files for malicious software or malware on the device. Anti-virus vendors find new issues and update malware daily. Always install the latest software updates on your computer

-

Two-factor authentication: Two-factor authentication adds an extra layer of protection beyond just a password. Not only do you enter your username and password, but you also enter a security code that the service provider can send to another device for extra protection.

-

Drive encryption: Drive encryption transforms sensitive data into unreadable code that unauthorized people cannot decipher easily, so only the authorized person can access the data.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Healthy Living Tip…

Tips For Eating Less Salt

Sodium isn’t entirely bad for our bodies, but too much can increase blood pressure and cause stress on the heart and blood vessels. Because of this, monitor your sodium intake and be aware of how much sodium is in your diet.

If you want to reduce your sodium intake, choose unprocessed or minimally processed foods. Prepared foods are generally high in added sodium compared to fresh options. Cut back on sources of high sodium, such as pepperoni pizza, white bread, processed cheese, deli meat and hot dogs, and other red meat and processed foods. Instead, eat more fruits, veggies, and whole grains, which are all lower in sodium.

Tip adapted from heart.org10

Weekly Riddle…

What has two hands but will never clap?

Last week’s riddle: Wide as a grapefruit, deep as a cup, but even a river can’t fill it up – What is it?

Answer: A kitchen strainer.

Photo of The Week…

Surat Thani Canal

Surat Thani, Thailand

Footnotes And Sources

1. The Wall Street Journal, July 19, 2024

2. CNBC.com, July 15, 2024

3. CNBC.com, July 16, 2024

4. MarketWatch.com, July 17, 2024

5. CNBC.com, July 18, 2024

6. The Wall Street Journal, July 19, 2024

7. KPMG.com, July 17, 2024

8. AP.com, July 16, 2024

9. IRS.gov, May 8, 2024

10. Heart.org, May 8, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.